You won't Believe This.. 31+ Reasons for Corporation Tax Form 1120? Figure their income tax liability.

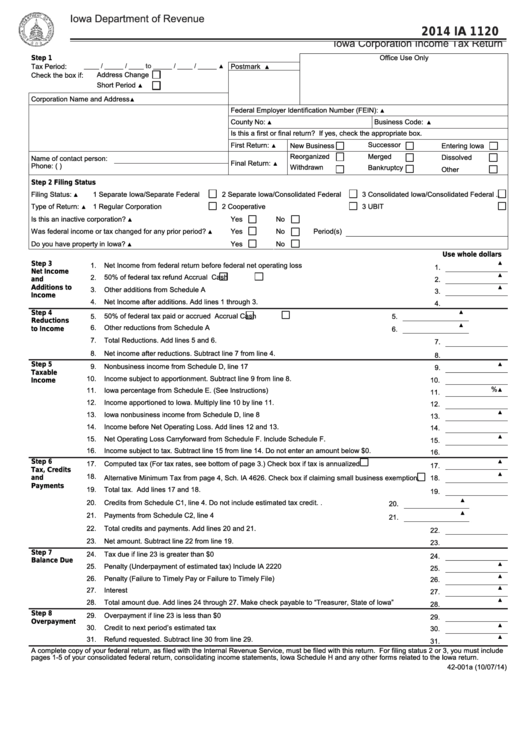

Corporation Tax Form 1120 | Corporations with few shareholders use the s corporation status to avoid double taxation on a. Disclosure of this information is required. This form is authorized as outlined by the illinois income tax act. Form 1120 is the u.s. Report their income, gains, losses, deductions, credits.

It can also be used to report income for other business entities that have elected to be taxed as corporations, such as an llc that has filed an election to use this tax option. It is an internal revenue service (irs) document that american corporations use to report their credits, deductions, losses, gains and income. This form is authorized as outlined by the illinois income tax act. Can be attached to a completed 1120 s. Since c corporations are separate entities from their owner or owners.

Corporation income tax return, is used to report corporate income taxes to the irs. Click the link to view the instructions or publication. Omissions and strikeouts are not permitted. However, there are many c corporation forms that are required to start and maintain this type of business, as per part of a c corp's operating agreement. Is the corporation required to file schedule utp (form 1120), uncertain tax position statement (see instructions)? It also helps corporations find out how much income tax they need to pay, according to the irs. Corporations with few shareholders use the s corporation status to avoid double taxation on a. Can be attached to a completed 1120 s. C corporations, or c corps, are considered separate entities to their owners (shareholders); Some small corporations with straightforward tax situations may be able to file form 1120 alone, but others may have to attach additional forms and schedules and file them with form 1120. By reporting your income, gains, losses, deductions and credits, you may figure your tax liability as well. Irs form 1120s, s corporation income tax return. Please file corporate income tax returns using form 1120 u.s.

If it is not linked it is not yet available. S corporations and form 1120s. Corporation income tax return as a stand alone tax form calculator to quickly calculate specific amounts for your 2021 tax return. Federally regulated exchanges v check this box if you attached. Domestic corporations use this form to:

Form 1120 is the u.s. Form 1120s is how s corporations report how much they make to the irs. Businesses set up as corporations can make. Alabama corporation income tax return. A c corporation is the most common type of corporation in the u.s. This form contains form 1120 along with. It is an internal revenue service (irs) document that american corporations use to report their credits, deductions, losses, gains and income. Disclosure of this information is required. Please file corporate income tax returns using form 1120 u.s. Who must use this form? However, there are many c corporation forms that are required to start and maintain this type of business, as per part of a c corp's operating agreement. Is the corporation required to file schedule utp (form 1120), uncertain tax position statement (see instructions)? What you'll learn how to enter tax data for an c corporation into form 1120 how to use tax software to input a form 1120.input process of a c corporation into tax form 1120.

Corporation income tax return filing deadlines: Form 1120s reports the income, losses, and dividends of each s corporation shareholder. S corporations and form 1120s. If a corporation is a separate entity, it's owners don't pay the taxes, but a corporation pays income fees by filing tax return. The 1120 form is for the entities separated from their shareholders.

Some small corporations with straightforward tax situations may be able to file form 1120 alone, but others may have to attach additional forms and schedules and file them with form 1120. Irs form 1120, the u.s. To download the form 1120 in printable format and to know about the use of this form, who can use this form 1120 and when one should use this form 1120 form. It also helps corporations find out how much income tax they need to pay, according to the irs. Businesses set up as corporations can make. Corporation income tax return as a stand alone tax form calculator to quickly calculate specific amounts for your 2021 tax return. But that money doesn't go to the irs. This form is authorized as outlined by the illinois income tax act. Corporations with few shareholders use the s corporation status to avoid double taxation on a. Irs form 1120s, s corporation income tax return. Omissions and strikeouts are not permitted. Can be attached to a completed 1120 s. This form contains form 1120 along with.

By reporting your income, gains, losses, deductions and credits, you may figure your tax liability as well corporation tax form. Omissions and strikeouts are not permitted.

Corporation Tax Form 1120: Corporations with few shareholders use the s corporation status to avoid double taxation on a.

Source: Corporation Tax Form 1120

Post a Comment

Post a Comment